Bolstered by new polls and fresh off their vote to bar an increase in the nation's $14.3 trillion

debt ceiling,

House Republicans swaggered into the White House Wednesday for the latest negotiation to end their

economic hostage taking. One,

Rep. Jeff Landry of Louisiana, refused to attend and be "lectured to by a president whose failed policies have put our children and grandchildren in a huge burden of debt."

Sadly for Rep. Landry, the nation's mounting debt is largely attributable to wars, a recession and tax policies President Obama inherited from his predecessor. Worse still, the Ryan 2012 budget proposal backed by almost every Republican in both houses of Congress would not only drain another $4 trillion in tax revenue from the Treasury, but fail all of the spending and balanced budget targets they themselves propose. Nevertheless, Republicans who voted seven times to double the debt ceiling under George W. Bush would risk the national economic suicide they admit would come to pass if their demands are not met.

Here, then, are

10 Inconvenient Truths About the Debt Ceiling:

1. Republican Leaders Agree U.S. Default Would Be a "Financial Disaster"

2. Ronald Reagan Tripled the National Debt

3. George W. Bush Doubled the National Debt

4. Republicans Voted Seven Times to Raise Debt Ceiling for President Bush

5. Federal Taxes Are Now at a 60 Year Low

6. Bush Tax Cuts Didn't Pay for Themselves or Spur "Job Creators"

7. Ryan Budget Delivers Another Tax Cut Windfall for Wealthy

8. Ryan Budget Will Require Raising Debt Ceiling - Repeatedly

9. Tax Cuts Drive the Next Decade of Debt

10. $3 Trillion Tab for Unfunded Wars Remains Unpaid

(Click a link to jump to the data and details for each.)

1. Republican Leaders Agree U.S. Default Would Be a "Financial Disaster"

Senator

Pat Toomey (R-PA), Rep.

Michele Bachmann (R-MN) and White House hopeful

Tim Pawlenty are among the GOP luminaries who have joined the ranks of what Dana Milbank called the "

default deniers." But you don't have to take Treasury Secretary Timothy Geithner's word for it "that if Congress doesn't agree to an increase in the debt limit by August 2, the United States will be forced to default on its debt, potentially spreading panic and collapse across the globe." As it turns out, Republican leaders (and their

big business backers) have said the same thing.

In their few moments of candor, Republican leaders expressed agreement with

Tim Geithner's assessmentthat default by the U.S. "would have a catastrophic economic impact that would be felt by every American." The specter of a global financial cataclysm has been described as resulting in "severe harm" (McCain economic adviser

Mark Zandi), "financial collapse and calamity throughout the world" (Senator

Lindsey Graham) and "you can't not raise the debt ceiling" (House Budget Committee Chairman

Paul Ryan). In January,

even Speaker John Boehner acknowledged as much:

"That would be a financial disaster, not only for our country but for the worldwide economy. Remember, the American people on election day said, 'we want to cut spending and we want to create jobs.' And you can't create jobs if you default on the federal debt."

2. Ronald Reagan Tripled the National Debt

Among the Republicans who prophesied the default doomsday scenario was none other than conservative patron saint,

Ronald Reagan. As he warned Congress in November 1983:

"The full consequences of a default -- or even the serious prospect of default -- by the United States are impossible to predict and awesome to contemplate. Denigration of the full faith and credit of the United States would have substantial effects on the domestic financial markets and the value of the dollar."

Reagan knew what he was talking about. After all, the hemorrhage of red ink at the U.S. Treasury was his doing.

As most analysts predicted, Reagan's massive $749 billion

supply-side tax cuts in 1981 quickly produced even more massive annual budget deficits. Combined with his rapid increase in defense spending, Reagan delivered not the balanced budgets he promised, but record-setting debt. Even his

OMB alchemist David Stockman could not obscure the disaster with his famous "rosy scenarios."

Forced to raise taxes eleven times to avert financial catastrophe, the Gipper nonetheless presided over

a tripling of the American national debt to nearly $3 trillion. By the time he left office in 1989, Ronald Reagan more than equaled the entire debt burden produced by the previous 200 years of American history. It's no wonder

Stockman lamented last year:

"[The] debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts."

It's no wonder the Gipper cited the skyrocketing deficits he bequeathed to America as

his greatest regret.

3. George W. Bush Doubled the National Debt

Following in Reagan's footsteps, George W. Bush buried the

myth of Republican fiscal discipline.

Inheriting a federal budget in the black and CBO forecast for a $5.6 trillion surplus over 10 years, President George W. Bush quickly set about dismantling the progress made under Bill Clinton.

Bush's $1.4 trillion tax cut in 2001, followed by a $550 billion second round in 2003,

accounted for the bulk of the yawning budget deficits he produced. (It is more than a little ironic that

Paul Ryan ten years ago called the tax cuts "too small" because he believed the estimated surplus Bush eviscerated would be even larger.)

Like Reagan and Stockman before him, Bush resorted to the

rosy scenario to claim he would halve the budget deficit by 2009. Before the financial system meltdown last fall,

Bush's deficit already reached $490 billion. (And even before the passage of the Wall Street bailout,

Bush had presided over a $4 trillion increase in the national debt, a staggering 71% jump.)

By January 2009, the mind-numbing deficit figure reached $1.2 trillion, forcing President Bush to

raise the debt ceiling to $11.3 trillion.

4. Republicans Voted Seven Times to Raise Debt Ceiling for President Bush

"Reagan," Vice President Dick Cheney famously declared in 2002, "proved deficits don't matter." Not, that is, unless a Democrat is in the White House.

As Donny Shaw documented in January 2010, Republican intransigence on the debt ceiling only began in earnest

when Bush left the White House for good.

The Republicans haven't always been against increasing the federal debt ceiling. This is the first time in recent history (the past decade or so) that no Republican has voted for the increase. In fact, on most of the ten other votes to increase the federal debt limit that the Senate has taken since 1997, the Republicans provided the majority of the votes in favor.

As it turns out,

Republican majorities voted to raise the U.S. debt ceiling seven times while George W. Bush sat in the Oval Office. (It should be noted, as

Ezra Klein did, that party-line votes on debt ceiling increases tied to other legislation is not solely the province of the GOP.) As ThinkProgress pointed out, during the Bush presidency, the

current GOP leadership team voted 19 times to increase debt limit. During his tenure, the U.S. national debt doubled, fueled by the Bush tax cuts of 2001 and 2003, the Medicare prescription drug plan and the unfunded wars in Iraq and Afghanistan. And Mitch McConnell and John Boehner voted for all of it and the debt which ensued because, as

Orrin Hatch later explained:

"It was standard practice not to pay for things."

5. Federal Taxes Now at a 60 Year Low

Even as Vice President Biden leads bipartisan negotiations to trim at least $1 trillion from the national debt, Republican leaders faithfully regurgitate the refrain that tax increases are "off the table." In one form or another, Mitch McConnell, Eric Cantor and just about every other conservative mouthpiece parroted Speaker John Boehner's line that:

"Medicare, Medicaid - everything should be on the table, except raising taxes."

Which purely by the numbers (if not ideology) is an odd position to take. After all, as a percentage of the U.S. economy, the total federal tax bite hasn't been this low in 60 years.

As the chart representing President Obama's 2012 budget proposal above reflects, the American tax burden hasn't been this low in generations. Thanks to the combination of the

Bush Recession and the latest Obama tax cuts, the

AP reported, "as a share of the nation's economy, Uncle Sam's take this year will be the lowest since 1950, when the Korean War was just getting under way." In January, the Congressional Budget Office (

CBO) explained that "revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950." That finding echoed an earlier analysis from the Bureau of Economic Analysis. Last April, the

Center on Budget and Policy Priorities concluded, "Middle-income Americans are now paying federal taxes at or near historically low levels, according to the latest available data." As

USA Today reported last May, the BEA data debunked yet another right-wing myth:

Federal, state and local taxes -- including income, property, sales and other taxes -- consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8% of income before rising slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty much nuts," says Michael Ettlinger, head of economic policy at the liberal Center for American Progress.

Or as former Reagan Treasury official

Bruce Bartlett explained it this week the New York Times:

In short, by the broadest measure of the tax rate, the current level is unusually low and has been for some time. Revenues were 14.9 percent of G.D.P. in both 2009 and 2010.

Yet if one listens to Republicans, one would think that taxes have never been higher, that an excessive tax burden is the most important constraint holding back economic growth and that a big tax cut is exactly what the economy needs to get growing again.

6. Bush Tax Cuts Didn't Pay for Themselves or Spur "Job Creators"

That Republican intransigence persists despite the complete debunking of two of the GOP's favorite myths.

The first tried and untrue Republican talking point is that "

tax cuts pay for themselves." Sadly, that right-wing mythmaking is belied by the massive Bush deficits, half of which (as the CBPP chart in section 3 above shows} were the result of the Bush tax cuts themselves. As a percentage of the American economy, tax revenues peaked in 2000; that is, before the Bush tax cuts of 2001 and 2003. Despite

President Bush's bogus claim that "You cut taxes and the tax revenues increase," Uncle Sam's cash flow from individual income taxes did not return to its pre-dot com bust level until 2006.

The second GOP fairy tale, as expressed by Speaker Boehner, is that "The top one percent of wage earners in the United States...pay forty percent of the income taxes...The people he's {President Obama] is talking about taxing are the very people that we expect to reinvest in our economy."

If so,

the Republican's so-called "Job Creators" failed to meet those expectations under George W. Bush. After all,

the last time the top tax rate was 39.6% during the Clinton administration, the United States enjoyed rising incomes, 23 million new jobs and budget surpluses. Under Bush? Not so much.

On January 9, 2009, the Republican-friendly

Wall Street Journal summed it up with an article titled simply, "

Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The dismal 3 million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the

Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

As

David Leonhardt of the New York Times aptly concluded last year:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7.

7. Ryan Budget Delivers Another Tax Cut Windfall for Wealthy

Looking at that dismal performance, Leonhardt rightly asked, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" At a time of

record income inequality which saw the incomes of the

richest 400 Americans taxpayers double even as their tax rates were halved, that's a fair question to say the least.

For Paul Ryan and the Republican Party, the answer is simple: because we said so.

As

Ezra Klein,

Paul Krugman and

Steve Benen among others noted, the House Republicans "Plan for America's Job Creators" is simply a repackaging of years of previous proposals and GOP bromides. (As Klein pointed out, the

10 page document "looks like the staffer in charge forgot the assignment was due on Thursday rather than Friday, and so cranked the font up to 24 and began dumping clip art to pad out the plan.") At the center of it is the

same plan from the Ryan House budget passed in April to cut the top individual and corporate tax rates to 25%.

The

price tag for the Republican proposal is a jaw-dropping $4.2 trillion. And as

Matthew Yglesiasexplained, earlier analyses of similar proposals in Ryan's Roadmap reveal that working Americans would have to pick up the tab left unpaid by upper-income households:

This is an important element of Ryan's original "roadmap" plan that's never gotten the attention it deserves. But according to a Center for Tax Justice analysis (PDF), even though Ryan features large aggregate tax cuts, ninety percent of Americans would actually pay higher taxes under his plan.

In other words, it wasn't just cuts in middle class benefits in order to cut taxes on the rich. It was cuts in middle class benefits and middle class tax hikes in order to cut taxes on the rich. It'll be interesting to see if the House Republicans formally introduce such a plan and if so how many people will vote for it.

We now know the answer: 235 House Republicans and 40 GOP Senators.

8. Ryan Budget Will Require Raising Debt Ceiling - Repeatedly

Largely overlooked in the media coverage of the Republican debt ceiling hostage drama is this: those 235 House Republicans and 40 GOP Senators who supported Paul Ryan's 2012 budget bill

voted to add $6 trillion to the U.S. national debt over the next decade. And that means, as Speaker

John Boehner acknowledged, Republicans now and in the future would have to increase the debt ceiling - repeatedly.

Of course, you'd never know that based on the incendiary rhetoric from the leading lights of the Republican Party and their right-wing echo chamber. Senator

Rand Paul (R-KY) said his vote to bump up the debt ceiling would come at the cost of a balanced budget amendment to the Constitution, "the last time we're doing it." His South Carolina colleague

Jim Demint threatened to filibuster the increase, even if it meant the GOP's "Waterloo." The number two House Republican

Eric Cantor (R-VA) regurgitated that line, telling Democrats the GOP "will not grant their request for a debt limit increase" without major spending cuts or budget process reforms." For his part, House Budget Committee Chairman

Paul Ryan insisted, "We won't raise, just simply raise, the debt limit," adding, "We will vote to have spending cuts and controls in conjunction with the debt limit increase." As

giddy right-wing bloggers like

Patterico described the right-wing's scorched earth strategy:

If Republicans are going to vote to raise the debt ceiling -- and not to do so will indeed cause financial chaos -- they have to extract concessions sufficient that they can credibly say: this is the last such vote we will ever have to have.

Sadly, as

Ezra Klein of the Washington Post explained last month, "Republicans can't meet their own deficit and spending targets." The Ryan plan to privatize Medicare, slash and convert Medicaid into block grants, and deliver another tax-cut windfall for the wealthy nevertheless "blows through both their spending and debt caps":

House Republicans voted to make the Ryan budget law. But the Ryan budget includes $6 trillion in new debt over the next 10 years, which means that to become law, the Ryan budget would require a substantial increase in the debt ceiling. But before the Republicans agree to increase the debt ceiling so that the budget they passed can become law, Republicans are demanding the passage of either a balanced budget amendment that would make the Ryan budget unconstitutional or a spending cap that the Ryan budget would, in certain years (and if you're using more realistic numbers, in all years), exceed.

It's no wonder Klein's Washington Post colleague Matt Miller deemed the Republican budgetary horror story "

The Shining - National Debt Edition" before concluding that Boehner's "

awe-inspiring hypocrisy on the debt limit" is one of those moments of "political behavior that can only be dubbed Super-Duper Hypocrisy So Brazen They Must Really Think We're Idiots."

9. Tax Cuts Drive the Next Decade of Debt

"President Obama's agenda, ambitious as it may be, is responsible for only a sliver of the deficits, despite what many of his Republican critics are saying," the New York Times'

David Leonhardt explained in 2009, adding, "The economic growth under George W. Bush did not generate nearly enough tax revenue to pay for his agenda, which included tax cuts, the Iraq war, and Medicare prescription drug coverage." That fall, former Reagan Treasury official

Bruce Bartlett offered just that kind of honesty to the

born again deficit virgins of his Republican Party. Noting that the FY2009 deficit of $1.4 trillion was solely due to lower tax revenues and not increased spending, Bartlett concluded:

"I think there are grounds on which to criticize the Obama administration's anti-recession actions. But spending too much is not one of them. Indeed, based on this analysis, it is pretty obvious that spending - real spending on things like public works - has been grossly inadequate. The idea that Reagan-style tax cuts would have done anything is just nuts."

Which is exactly right. Thanks to the steep recession, as the Congressional Budget Office (CBO) and others have documented time and again, the

overall federal tax burden as a percentage of GDP is now down to levels not seen since Harry Truman was in the White House. (The

two-year tax cut compromise in December didn't help any, adding $400 billion to the deficit this year and next.) But is the Bush tax cuts themselves, which Republicans want to make permanent and then (as the Ryan budget mandates) lower further, which account for much of the revenue drain into the future.

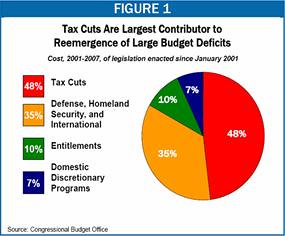

As a recent analysis by the

Center on Budget and Policy Priorities showed (see chart at top), over the next decade the Bush tax cuts account for more of the nation's debt than Iraq, Afghanistan, TARP, the stimulus, and revenue lost to the recession combined:

10. $3 Trillion Tab for Unfunded Wars Remains Unpaid

Over the next ten years, the costs of America's wars in Iraq and Afghanistan will decline as the U.S. commitments there come to an end. But almost ten years, 6,000 U.S. dead and over a trillion dollars after the attacks of September 11,

it's time to pay for our wars.

In May, the

National Journal estimated that the total cost to the U.S. economy of the war against Al Qaeda will reach $3 trillion. In 2008, Nobel Prize-winning economist

Joseph Stiglitz put the price of the Iraq conflict alone at $3 trillion.

But by 2020 and beyond, the direct cost to U.S. taxpayers could reach $3 trillion. In March, the

Congressional Research Service put the total cost of the wars at $1.28 trillion, including $806 billion for Iraq and $444 billion for Afghanistan. For the 2012 fiscal year which begins on October 1,

President Obama asked for $117 billion more. (That war-fighting funding is over and above

Secretary Gates' $553 billion Pentagon budget request for next year.)

But in addition to the roughly $1.5 trillion tally for both conflicts through the theoretical 2014 American draw down date in Afghanistan, the U.S. faces staggering bills for veterans' health care and disability benefits. Last May,

an analysis by the Center for American Progress estimated the total projected total cost of Iraq and Afghanistan veterans' health care and disability could reach between $422 billion to $717 billion. Reconstruction aid and other development assistance represent tens of billions more, as does the additional interest on the national debt. And none of the above counts the expanded funding for the new Department of Homeland Security.

But that two-plus trillion dollar tab doesn't account for the expansion of the United States military since the start of the "global war on terror." As

a percentage of the American economy, defense spending jumped from 3.1% in 2001 to 4.8% last year. While ThinkProgress noted that the Pentagon's FY 2012 ask is "the largest request ever since World War II,"

McClatchy explained:

Such a boost would mark the 14th year in a row that Pentagon spending has increased, despite the waning U.S. presence in Iraq. In dollars, Pentagon spending has more than doubled in 10 years. Even adjusted for inflation, the Defense Department budget has risen 65% in the past decade.

Even as the World Trade Center site was still smoldering, Republicans insisted Al Qaeda represented an existential threat to the United States.

President Bush repeatedly compared 9/11 to Pearl Harbor and his war on terror to World War II. But he never asked Americans to join the military or sacrifice at home. Instead, Bush told us to go shopping and "

get down to Disney World."

From a public policy standpoint, post-9/11 America in no way resembles FDR's response to Pearl Harbor.

George W. Bush was the first modern president to

cut taxes during wartime. Barack Obama was the second.

Its time, as

Bernie Sanders,

Al Franken and the

Congressional Progressive Caucus each proposed, to begin paying for the unfunded conflicts fought in our name.

(This piece also appears at Perrspectives.)